Weekly Update: What is your favorite book?

September 9th, 2013

What is your favorite book?

- Today, I share my favorite book (hint: it's the book, behind the books!)

- YOU share YOUR favorite book!

- The keys to finding a great book!

Comment below! -- What is your favorite book?

Suggest your favorite book below! Also, please add any other interesting "nuggets" you think others will like!

Note: If you don't see comments, it's because you aren't logged into Facebook.

Your "Old School" Text-Heavy Weekly Update

In This Week's Weekly Update:

Tip of the Week: Is your email inbox feeling out of control? These simple tips can help.

Last Week in Review: The job market is laboring on, but is it moving in the right direction?

Forecast for the Week: Look for several key items at the end of the week, including wholesale inflation, retail sales, and more.

Are You Buried in Email?

These Simple Tips Can Help

Have you ever felt like some of the technology developed to streamline your workday has actually had the opposite result? Email is often one of the biggest offenders. Here are some great tips to help you manage your inbox.

Put key information in your signature. Use the signature field so that you always communicate information in the way you want to share it. Consider creating multiple signatures for various types of emails your send regularly. Examples of items you can include are links to web pages you want people to visit in the near term, answers to current Frequently Asked Questions, and the areas of focus you want your clients to know you are currently researching. Your traditional contact information should also be included.

BCC yourself so nothing slips through your follow up list. BCC yourself on communications you know you will need to follow up on. Consider setting up a rule in your email system so that any email FROM you and TO you automatically goes to a “Follow Up” folder. This way, you need only look in one place to find what you’re looking for when you’re ready to follow up with someone.

Use subject lines to the fullest. A best practice of effective email collaboration: Place a verb at the front of the subject line. Then, use the body of the email to expand on and describe what needs to be done. About the worst thing you can do is to include no subject line at all in the emails you send. In addition, as you send email, especially if it is information that is time sensitive or action oriented, ensure recipients understand this when they see the email in their inbox.

Take time for focused concentration. Some of the emailing you have can be done in between meetings, or while you’re waiting on hold for a conference call to start. Other emails will require more focus, longer time periods and fewer distractions. For the latter, consider carving out several no-interruption periods during your day so you can focus solely on emails requiring a longer response.

These tips are tried and true for a reason: they really do work when you use them…and use them consistently! Be sure to pass them along to your friends and family!

“Work, work, work, it’s a labor of love.” The words to Sammy Kershaw’s country song may sound sweeter than the latest employment numbers that were released last week. Read on for details.

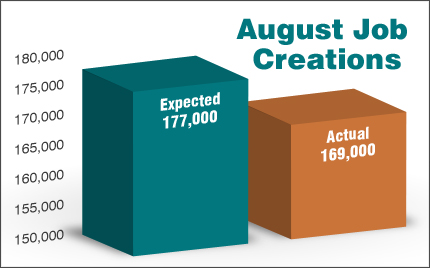

The Jobs Report for August didn’t show much love for workers as the Labor Force Participation Rate, which measures the number of people who are either employed or are actively looking for work, fell to its lowest level in 35 years. Job creations were also lower than expected, with 169,000 jobs created in August versus 177,000 expected. Many of these jobs were in the retail and leisure sectors. Compounding this number, job creations for June and July were revised lower, shaving 74,000 jobs from the previous reports.

The Jobs Report for August didn’t show much love for workers as the Labor Force Participation Rate, which measures the number of people who are either employed or are actively looking for work, fell to its lowest level in 35 years. Job creations were also lower than expected, with 169,000 jobs created in August versus 177,000 expected. Many of these jobs were in the retail and leisure sectors. Compounding this number, job creations for June and July were revised lower, shaving 74,000 jobs from the previous reports.

The unemployment rate did drop to 7.3 percent–the lowest level since December 2008. However, this number was likely lowered by people leaving the labor force rather than organic job growth. It’s also important to note that outplacement firm Challenger, Gray & Christmas said that planned layoffs surged by nearly 40 percent from July to August, reaching the highest level in six months.

In housing news, research firm CoreLogic reported that home prices rose 12.4 percent on a year-over-year basis in the month ended in July. This marks the seventeenth consecutive month of year-over-year price gains. However, home prices remain 17.6 percent below their peak levels, which were set in April 2006.

What does this mean for home loan rates? Weak economic reports can often cause investors to move money out of Stocks and into safer investments like Bonds, including Mortgage Bonds to which home loan rates are tied. We saw some of that dynamic late last week, as Bonds improved after the weak Jobs Report.

The Fed has said that economic data will be a key factor in when it begins tapering the $85 billion in Bond purchases it has been making each month to stimulate the economy and housing market. These purchases have helped home loan rates remain attractive. With economic conditions still wobbly and the housing recovery fragile, the Fed will be watching upcoming economic reports closely.

The bottom line is that now remains a great time to consider a home purchase or refinance as home loan rates remain attractive compared to historical levels. Let me know if I can answer any questions at all for you or your friends!

The economic data doesn’t begin until late in the week, with several key reports due out on Friday.

- As usual, weekly Initial Jobless Claims will be released on Thursday. Despite the poor Jobs Report for August, claims have been hovering near 6-year lows.

- Friday brings the Producer Price Index (which measures inflation at the wholesale level), Retail Sales and Consumer Sentiment.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on.

When you see these Bond prices moving higher, it means home loan rates are improving — and when they are moving lower, home loan rates are getting worse.

To go one step further — a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning.

As you can see in the chart below, Bonds were able to improve after the weaker than expected Jobs Report for August. I’ll be watching the markets closely as we head toward the upcoming Fed meeting.

Not subscribed? Subscribe today!

Get our weekly updates delivered to you (for FREE) by email every Monday at 9:30am CST!

We hate spam as much as you do. Your email is safe with us.

How can we help you?

Do you know someone relocating to central Iowa?

Raving Fans

"My husband and I worked with The Tyler Osby Team in purchasing our first home. Tyler and his team helped us through the entire process and made it a very simple, quick, and easy process. They are a very knowledgeable, trustworthy and honest company to work with and were always available to answer any questions we had in a prompt manner. We highly recommend their service for your mortgage needs!" Katie and Jon

"My husband and I worked with The Tyler Osby Team in purchasing our first home. Tyler and his team helped us through the entire process and made it a very simple, quick, and easy process. They are a very knowledgeable, trustworthy and honest company to work with and were always available to answer any questions we had in a prompt manner. We highly recommend their service for your mortgage needs!" Katie and Jon

Courtesy of: Facebook Reviews

"I interviewed several mortgage lenders prior to buying my first house. My realtor told me to contact The Tyler Osby Team, so I reached out. Tyler emailed me back the same day and helped me get through the application process (the tutorial video is excellent). He is friendly, professional and knowledgeable, but above all else, he is trustworthy. The whole mortgage process was a breeze from start to close. I wouldn't dream of going anywhere else for my mortgage needs." Camera-Shy

"I interviewed several mortgage lenders prior to buying my first house. My realtor told me to contact The Tyler Osby Team, so I reached out. Tyler emailed me back the same day and helped me get through the application process (the tutorial video is excellent). He is friendly, professional and knowledgeable, but above all else, he is trustworthy. The whole mortgage process was a breeze from start to close. I wouldn't dream of going anywhere else for my mortgage needs." Camera-Shy

Courtesy of: Zillow Reviews

Legal Stuff

Some of the material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is not without errors.

I'd like to consider myself your trusted advisor. So, I am sending you this weekly update because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

If you don't enjoy receiving this update, no problem! Please simply unsubscribe (a/k/a "Update Profile") in the email where you clicked through to this webpage and we can remove you from our list of super-cool people that receive this 🙂

Seriously though, I hope you enjoy reading/watching this as much as I enjoy producing it each week. Thank you for being a life-long learner with me.

Licensing Information:

Fairway Independent Mtg.

NMLS ID # 8668

Iowa Mortgage Banker License No. 2002-0130

Equal Housing Lender